In a world where seamless financial integration is key, Knex emerges as the ultimate link between innovation and efficiency.

Derived from "Connects," Knex embodies the power of frictionless API solutions, bridging institutions, fintechs, and developers with cutting-edge financial technology.

Built for agility and scalability, Knex transforms complex financial processes into effortless connections—whether through payments, banking, lending, or compliance.

More than just an API provider, Knex is a network enabler, ensuring that businesses stay ahead in an interconnected digital economy.

Mission Statement

To operate as a platform for the delivery of meaningful fintech:

“Move money & data,

create markets”

Mission Statement

To operate as a platform for the delivery of meaningful fintech:

“Move money & data,

create markets”

Reasoning

APIs are our major tool to manage inclusion in Fintech.

At FUND4ALL, we believe fintech should work for everyone, everywhere. We were founded to make financial services accessible to all, breaking down barriers of location and time. By fostering inclusion and leveraging technology, we aim to not only enhance current solutions but also build new markets and opportunities for growth.

APIs are our major tool to manage inclusion in Fintech.

At FUND4ALL, we believe fintech should work for everyone, everywhere. We were founded to make financial services accessible to all, breaking down barriers of location and time. By fostering inclusion and leveraging technology, we aim to not only enhance current solutions but also build new markets and opportunities for growth.

A strategic alliance key for our future:

Access in > 3.500 engineers all around the globe, through own database

Fintech experience and current projects

A large international network of advisors

FUND4ALL API Management platform

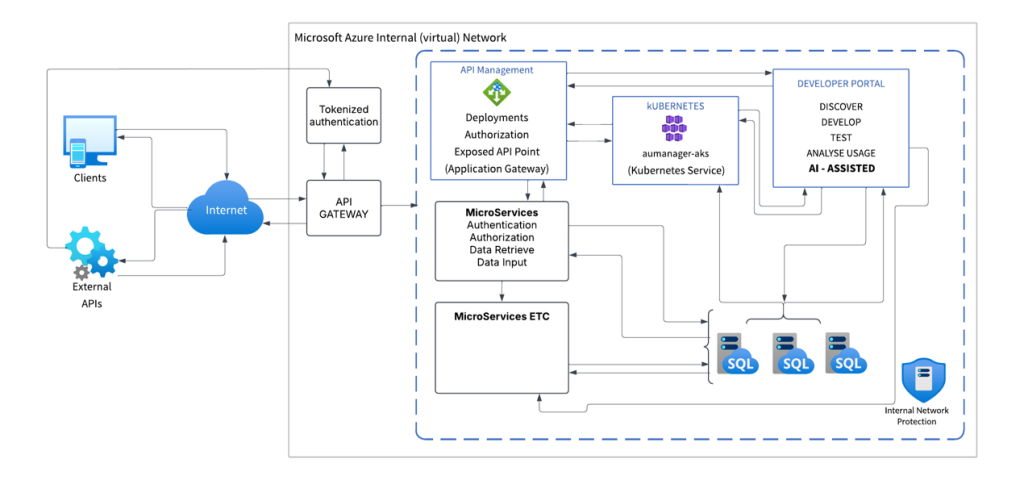

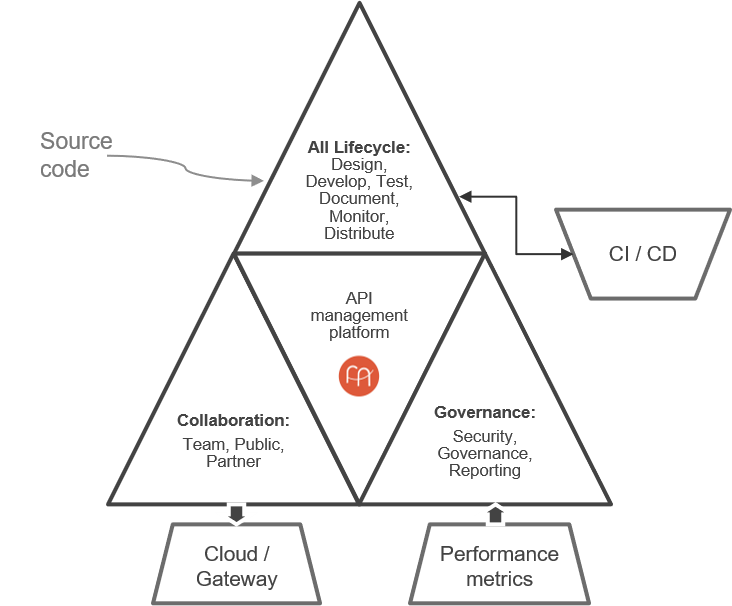

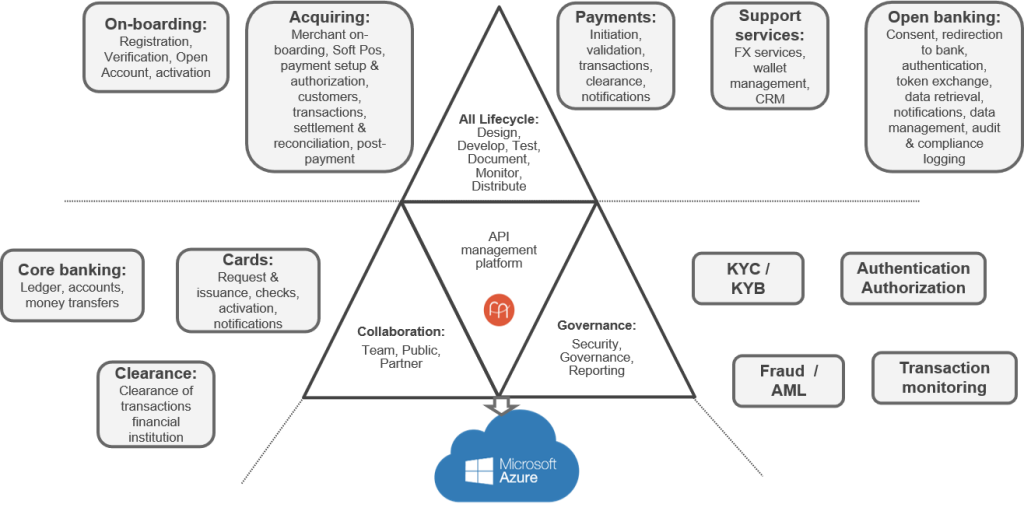

API Platform at a glance

A platform that manages APIs lifecycle and collaboration, ensures their compliance and facilitates their deployment

APIs do not do nothing else than supporting capabilities of the main services. We do not build API sets, we build capabilities that are supported from API sets, which differentiate based on the data sets per se.

It is more important which data sets we use, how we combine them and when we renew them, than the tech itself. This is how we differentiate from big tech, on how we use the APIs.

Two main offers:

White label offer: We build eco-systems of APIs as requested from the client, based on the capabilities the client wants to offer

Vertical offer: Pre-manufactured API platform, based on capabilities we have pre-integrated and data sets we have selected, for specific non-financial verticals

A pre-configured API Platform for EMIs

A platform operating with the capabilities needed for an EMI to fully operate

Team Augmentation

F4A just adds

F4A just adds

engineers to client team, for a specific time frame and admins them. Best used from large corporates in fin services sector.

Product Development

Client requests

Client requests

a deliverable and F4A builds a project team, manages it and delivers in time, on specs. Better for fintech startups and banks which wants specific add ons

Build - Operate -Transfer

Client requests

Client requests

a deliverable on a project that is not its core. F4A builds a team, manages it, runs the project until tech matures and delivers to client. Best of banks and large corporations which do not want to disturb their resources

New Product Strategy

Client is

Client is

a non financial institution and wants to enter fintech. F4A proposed bu models, tech, deliverable and builds a team to make it happen. Utilities, retail, telcos, marketplaces are ideal users

how we do it

We provide great tech

We provide great tech

ENGAGEMENT MODELS

TEAM AUGMENTATION

6-12

months min contracts

F4A

Admin

Cost +

admin margin (5-10%), depending on team volume

PRODUCT DEVELOPMENT

One-off

delivery teams

Usually for

short to mid-term gap closure support

Fixed

Payment on deliverable

BUILD – OPERATE - TRANSFER

Long term

support with a dedicated team to cover all functionalities

For financial

institutions and relevant companies

Retainer fee

+ deliverable fee + Yearly maintenance & support

NEW PRODUCT STRATEGY

Longer term

support with a dedicated team to cover all functionalities

For non-financial

institutions (embedded)

Advisory fee

+ Retainer fee + deliverable fee + Yearly maintenance & support

ENGAGEMENT MODELS

White Label offer

· Setup & Licensing

Basic Subscription

Advanced Subscription types

· Pay-as-you-go

· Partner model

· Add / or:

Marketplace model

Vertical offer

· Tiered

fixed + usage packages

Advanced Subscriptions

· Partner model

short to mid-term gap closure support

· Add / or:

Marketplace model

The two directors

founder and CEO of F4A

Socratis Ploussas

Socratis is the founder and CEO of F4A and is also working as a fintech advisor. He spent 19 of the 32 years in the market in large corporates (Coca-Cola, Samsung) and since 2009 he is self-employed. This is his 2nd start-up after and equity crowdfunding platform that he developed in 2013. He holds an MBA from Henley-Brunel in business administration.

founder and CEO of F4A

Socratis Ploussas

Socratis is the founder and CEO of F4A and is also working as a fintech advisor. He spent 19 of the 32 years in the market in large corporates (Coca-Cola, Samsung) and since 2009 he is self-employed. This is his 2nd start-up after and equity crowdfunding platform that he developed in 2013. He holds an MBA from Henley-Brunel in business administration.

co-founder and CEO of Sylipsis corporation

Konstantinos Michanetzis

Konstantinos is the co-founder and CEO of Sylipsis corporation and in this 31 years in the market, had the chance to invest 10 of them in the Hellenic navy and the rest in business directly related with IT and computing. Except Sylipsis, he now runs SEEDΕRS a co-working space, a digital media house and he is BoD member in MIT Enterprise forum. He holds MSC and an engineering degree from MIT.

co-founder and CEO of Sylipsis corporation

Konstantinos Michanetzis

Konstantinos is the co-founder and CEO of Sylipsis corporation and in this 31 years in the market, had the chance to invest 10 of them in the Hellenic navy and the rest in business directly related with IT and computing. Except Sylipsis, he now runs SEEDΕRS a co-working space, a digital media house and he is BoD member in MIT Enterprise forum. He holds MSC and an engineering degree from MIT.

why us

We support our clients to solve engineering

or design problems, to focus on their skillset and use ours to develop new products, faster and in a more flexible way, so they can go to market sooner and more efficiently. All SLA based, reported as variable expense.

why us

Go-To-Market

FUND4ALL goes to the market in 2 subscription business models :

1. White-label offer: On-demand API set

2. Vertical offer: Pre-configured API set

why us

Go-To-Market

FUND4ALL goes to the market in 2 subscription business models :

1. White-label offer: On-demand API set

2. Vertical offer: Pre-configured API set

why us

We support our clients to solve engineering

or design problems, to focus on their skillset and use ours to develop new products, faster and in a more flexible way, so they can go to market sooner and more efficiently. All SLA based, reported as variable expense.

For BANKS

- White-label offer

For EMIs

- White-label offer

- Vertical offer

For Merchants

- Vertical offer

For BANKS

- Rapid prototyping and validation

- Problem solving & agile approach

- Does not disturb everyday operation

For SCALE-UPS

- Fast delivery as investors request

- Reduced time-to-market

- Access to resources efficiently

- Highly-skilled and trained devs

For NON-FINANCIAL

- Used case generation

- Rapid prototyping and validation

- Fast and flexible implementation without disturbing core

VERTICALS ACTIVATION

Big data analytics

Payments

Cloud computing

Embbeding finance in industry solutions

Proptech

Cyber security

Fintech

Wealth tech

Proptech

Cyber security

Fintech

Wealth tech

VERTICALS ACTIVATION

Big data analytics

Payments

Cloud computing

Embbeding finance in industry solutions

Proptech

Cyber security

Fintech

Wealth tech

What DO our clients SAY

“Could not imagine the quality of the engineers and their commitment”

“Fast delivery, easy communication, ready to adopt…what a bank needs”

“Fast delivery, easy communication, ready to adopt…what a bank needs”

Payments gateway and experience

Payments gateway and experience

We developed a platform for the banks clients to upload their plans and documents, so that the officers rate them

We developed a platform for the banks clients to upload their plans and documents, so that the officers rate them

Business plans platform

Business plans platform

We developed a platform for the banks clients to upload their plans and documents, so that the officers rate them

We developed a platform for the banks clients to upload their plans and documents, so that the officers rate them

Blog

Fintech startups need to move faster

Fintech was used the last few years to easy and fast VC money. In Europe alone, boosted by pandemic, 2021-22, more than $50bil were invested, with the largest chunk being in deals over $100mio.

Embedded finance: challenging common assumptions

Every company will be a fintech company”. This phrase was spoken 4 years ago, from Angela Strange, general partner at Andreesen Horowitz, a legendary Valley VC firm.

Fintech startups need to move faster

Fintech was used the last few years to easy and fast VC money. In Europe alone, boosted by pandemic, 2021-22, more than $50bil were invested, with the largest chunk being in deals over $100mio.

Embedded finance: challenging common assumptions

Every company will be a fintech company”. This phrase was spoken 4 years ago, from Angela Strange, general partner at Andreesen Horowitz, a legendary Valley VC firm.

Managing Scale is critical for startups as well as corporates.

Scaling-up a start-up is the vision of every founder and usually he /she does whatever it takes to secure the exponential growth. Same with large corporations or banks or even governments, which introduce digital transformation projects and need to scale them up so they become the new business norm.

Banks need to manage digital transformation in a more flexible way

The digital transformation of banks has been a demand for several years. The European Central Bank, through ECB Banking Supervision, carried out an extensive survey of 105 institutions and spoke with their managements and advisors and concluded that while steps have been taken mainly towards a customer-centric approach (1/3 of customers basically use a mobile phone, while half of loans completed digitally), we are still a long way off and the rat

When it comes to digital transformation, co-operation is more efficient than introversion

Digital transformation has an impact that was not expected in its magnitude. All those involved in economic activity, even the smaller local companies, must integrate the development of technological applications into their processes, budgets, daily life, as they must check new models, good practices, etc.

Embedded finance: Banking everywhere and always

An extremely popular opinion of recent years is that "Every company will be a fintech company". This phrase is attributed to Angela Strange , general partner of Andreesen Horowitz and was made about 4 years ago. Although Ms. Strange mainly referred to payments and how they can become part of every "digital customer's" experience, soon the idea began to cover lending, mortgages, insurance, almost anything to do with a banking product that will cou